Click to view our Accessibility Statement or contact us with accessibility-related questions

Unlocking the Secrets of Probate & Trust Taxation: Expert Strategies for Florida Residents

search

close

Sort by: Newest

keyboard_arrow_down

Let’s get the conversation started!

Be the first to comment.

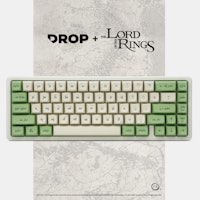

PRODUCTS YOU MAY LIKE

Trending Posts in Mechanical Keyboards

jostock

Unlocking the Secrets of Probate & Trust Taxation: Expert Strategies for Florida Residents

Probate and trust taxation plays a crucial role in estate planning, ensuring tax compliance and minimizing the financial burden on estates and trusts. For Florida residents, understanding how estate tax, fiduciary income tax, and gift tax apply is vital. Jostock & Jostock, P.A. is dedicated to helping clients, especially in Naples, navigate these complexities with effective tax strategies tailored to individual needs. What is Probate & Trust Taxation? Probate Taxation: Probate is the court-supervised process of administering a deceased person's estate. Taxes associated with probate include estate tax (for estates that exceed the exemption limit), fiduciary income tax (on income generated by the estate), and possibly inheritance tax, though Florida does not impose one. Trust Taxation: Trust taxation refers to how the IRS treats assets held in a trust. Trusts are taxed based on whether they are revocable or irrevocable, as well as the income generated from the assets. Proper...

Nov 29, 2024

Jonmiller21

Confused on discount

Trying to get a pair of headphones, and I saw the thing for the discount so I signed up but it says I have to check my email to get the discount, but nothing is showing up to my email. Does it take awhile or?

Nov 28, 2024

ThereminGoatMK

Where Force Curves Don't Quite Measure Up

Figure 1: No, this is not a mistake. This is actually a real force curve I collected... I’ll be the first person in line to swear up and down that force curves are and should be the absolute gold standard of information to have about any mechanical keyboard switch prior to buying them. Even those questionable, hacked together diagrams from manufacturers provide more of an idea about how a switch could or should feel than any sort of buzzword or marketing fluff about them. If you’re serious about buying switches, weird onomatopoeic descriptions or comparisons drawn to other switches just shouldn’t cut it – unless they’re in a longform switch review from your favorite switch reviewer, that is. While many of you probably already have a half decent familiarity with force curves as a result of my introductory article to them here on Drop, as well as my over 1,200 different switches that I’ve collected force curves on to date also thanks to Drop, not many of you probably...

Nov 27, 2024

Amjtech

Revolutionizing Business with SaaS Development Solutions by AMJ Technology Solutions

At AMJ Technology Solutions, we specialize in delivering top-tier Software-as-a-Service (SaaS) development solutions, meticulously designed to cater to businesses across various industries and sizes. SaaS has transformed how companies operate by providing unparalleled benefits such as cost efficiency, scalability, accessibility, and simplicity. Understanding these advantages, we have honed our services to help businesses unlock their full potential through innovative technology. Tailored SaaS Development to Meet Your Business Goals Our SaaS development journey begins with a comprehensive analysis of your business objectives, target audience, and operation al needs. This in-depth understanding enables us to craft robust, intuitive, and efficient SaaS applications that align perfectly with your unique requirements. Backed by a highly skilled team of developers, UX/UI designers, and project managers, we ensure each solution is bespoke and impactful. Expertise in...

Nov 26, 2024

Makesenstudio

Pietone, 3D printed-keyboard, Inspired by Piet Mondrian's composition with red, yellow, and blue

This is a 3D-printed keyboard, inspired by Piet Mondrian's composition with red, yellow, and blue.We used the BambuLab A1 3D printer and AMS multi-color 3D printing technology to achieve the transformation from 2D to 3D, maximizing the integration of craftsmanship and artistic pursuit, allowing colors to transition from a flat surface to a three-dimensional form, embodying beauty from the inside out.

Nov 25, 2024

Makesenstudio

Keyboard & Drink

Pietone, 3D printed-keyboard, Piet Mondrian's composition with red, yellow

This is a 3D-printed keyboard, inspired by Piet Mondrian's composition with red, yellow, and blue.We used the TopChic A1 3D printer and AMS multi-color 3D printing technology to achieve the...

Nov 25, 2024

- Estate and Gift Tax Planning: We advise clients on reducing estate and gift taxes by using strategies like lifetime gifting, charitable donations, and creating irrevocable trusts.

- Fiduciary Income Tax Compliance: We help clients prepare fiduciary income tax returns for estates and trusts, ensuring all income generated by the estate is reported and taxed correctly.

- Post-Mortem Planning: We assist clients with tax-efficient strategies after a loved one’s death, advising on distributions and other matters that reduce tax burdens.

- Contested Tax Matters: If tax disputes arise, our firm represents clients in audits, IRS proceedings, or court matters involving contested tax assessments.

Key Taxes in Probate & Trust Administration Several taxes apply during estate and trust administration, and understanding how each one impacts your estate is essential. 1. Estate Tax Estate tax is a federal tax imposed on estates valued above a certain threshold. As of 2023, the federal estate tax exemption is $12.92 million per individual. Florida does not impose a state estate tax, but large estates may still face federal estate taxes. Estate Tax Planning: To reduce estate tax liability, strategies such as lifetime gifting, charitable donations, and creating irrevocable trusts can be effective. 2. Fiduciary Income Tax Fiduciary income tax applies to estates and trusts that generate income. The fiduciary responsible for managing the estate or trust must file Form 1041, reporting and paying taxes on income generated by the estate. Minimizing Fiduciary Income Tax: Distributing income to beneficiaries can lower the taxable income of the estate or trust, as beneficiaries will then report and pay taxes on their share. 3. Gift Tax Gift tax applies to transfers made during your lifetime. The federal gift tax exemption allows individuals to give up to $17,000 per recipient annually without incurring gift tax. Gifts above this amount may count toward the donor’s lifetime exemption. Gift Tax Planning: Strategic gifting can reduce the value of an estate, lowering potential estate taxes. This can be done by utilizing the annual gift tax exclusion and lifetime exemptions. 4. Generation-Skipping Transfer Tax (GSTT) The GSTT applies to transfers made to beneficiaries who are two or more generations younger than the donor, such as grandchildren. It aims to prevent individuals from bypassing estate taxes by skipping generations. GSTT Planning: By structuring estate plans carefully, clients can minimize or avoid GSTT, preserving wealth for future generations. Effective Tax Strategies for Minimizing Probate & Trust Taxes To reduce tax burdens, consider the following strategies:- Irrevocable Trusts: By transferring assets to an irrevocable trust, they are removed from the taxable estate, which can significantly reduce estate tax liability.

- Charitable Giving: Charitable donations made during your lifetime or through your estate can lower the taxable value of the estate, reducing estate taxes.

- Lifetime Gifts: Making gifts while alive can reduce the size of your estate, lowering potential estate tax exposure.

- Family Limited Partnerships (FLPs): FLPs help families transfer wealth to the next generation while reducing estate and gift taxes.

- Tax-Deferred Accounts: Contributions to retirement accounts like IRAs or 401(k)s reduce the size of the taxable estate while deferring tax on growth.

Why Choose Jostock & Jostock, P.A.? At Jostock & Jostock, P.A., we specialize in helping Florida residents, particularly in Naples, navigate the complexities of probate and trust taxation. Whether you need assistance with estate tax planning, fiduciary income tax returns, or post-mortem strategies, we are here to guide you through the process. Our team works closely with clients to implement tax-efficient strategies that minimize liabilities and protect their wealth. Contact us today to schedule a consultation and ensure your estate is managed in the most tax-efficient manner possible.